A new way to invest in the European CLO market

1. ACCESS TO FLOATING RATE DEBT

Investors can access European floating rate debt with limited interest rate duration risk. This provides diversification to a traditional fixed income portfolio

Fair Oaks AAA CLO ETF is Euro denominated. The ETF is listed on Deutsche Börse Xetra, Borsa Italiana and the London Stock Exchange

2. ATTRACTIVE RETURNS

AAA-rated CLOs can offer a higher return than traditional fixed income products, such as investment-grade corporate bonds

Fair Oaks AAA CLO ETF is available in accumulating and distributing share classes (quarterly distributions) and in multiple currencies (EUR, USD and GBP)

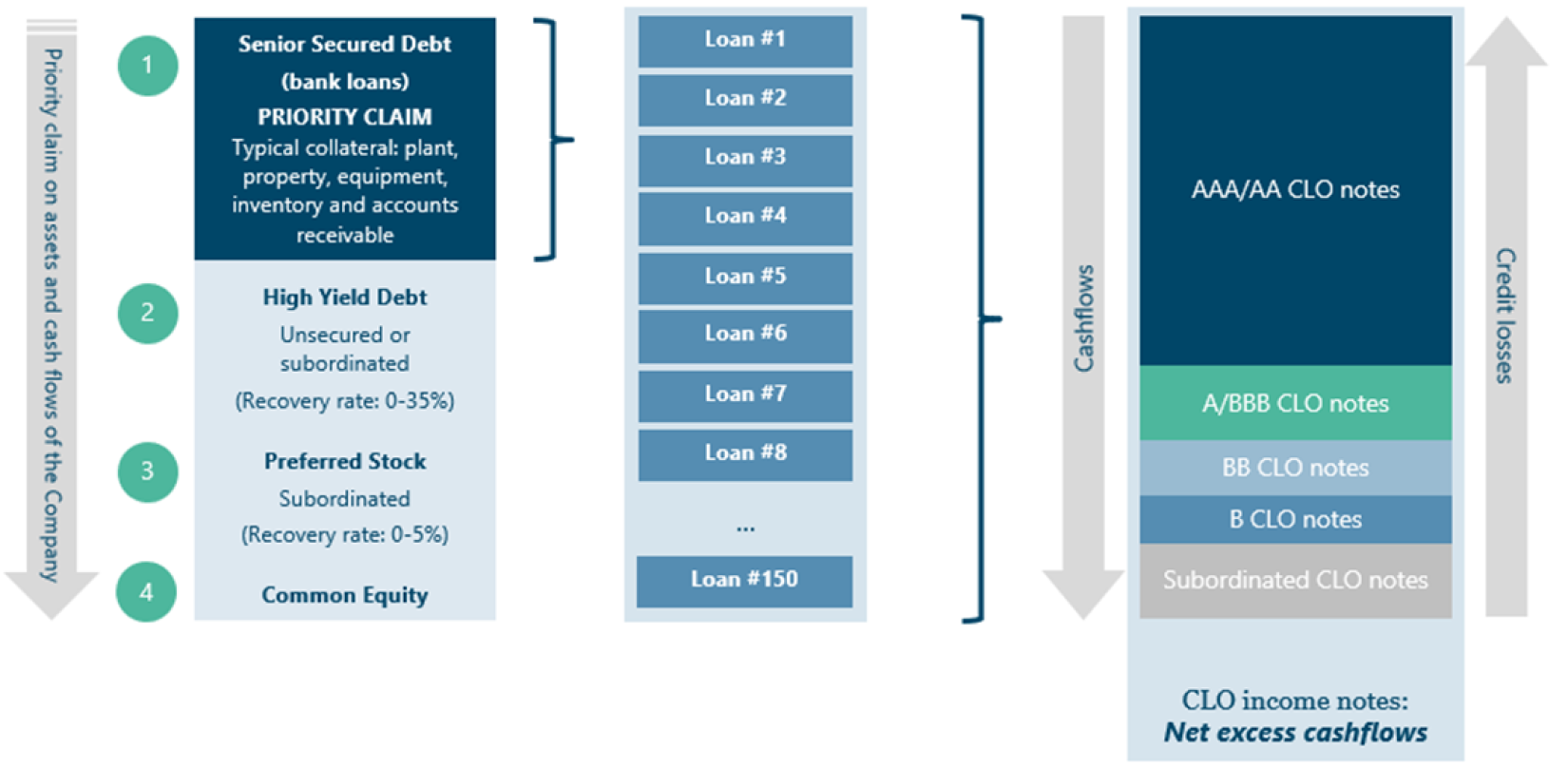

3. RESILIENT ASSET CLASS

No AAA-rated CLO has ever defaulted in over 25 years, when data records by major rating agencies began

Fair Oaks AAA CLO ETF offers access to AAA-rated CLO notes. Fair Oaks believes this resilience is due to the structural protections offered by CLOs

4. EFFICIENT AND TRANSPARENT

The ETF format allows for efficient and flexible trading while offering investors transparency

Fair Oaks AAA CLO ETF is the first European CLO ETF, pioneering a diversified CLO portfolio in an actively managed ETF wrapper to investors in Europe