About Us

Fair Oaks Capital

Fair Oaks Capital has won multiple awards since the launch of the Fair Oaks AAA CLO ETF, including "New ETF Issuer Of The Year" and "Innovative ETF Of The Year" in 2024 by ETF Stream

About CLO ETF share class trading

1. ACCESS

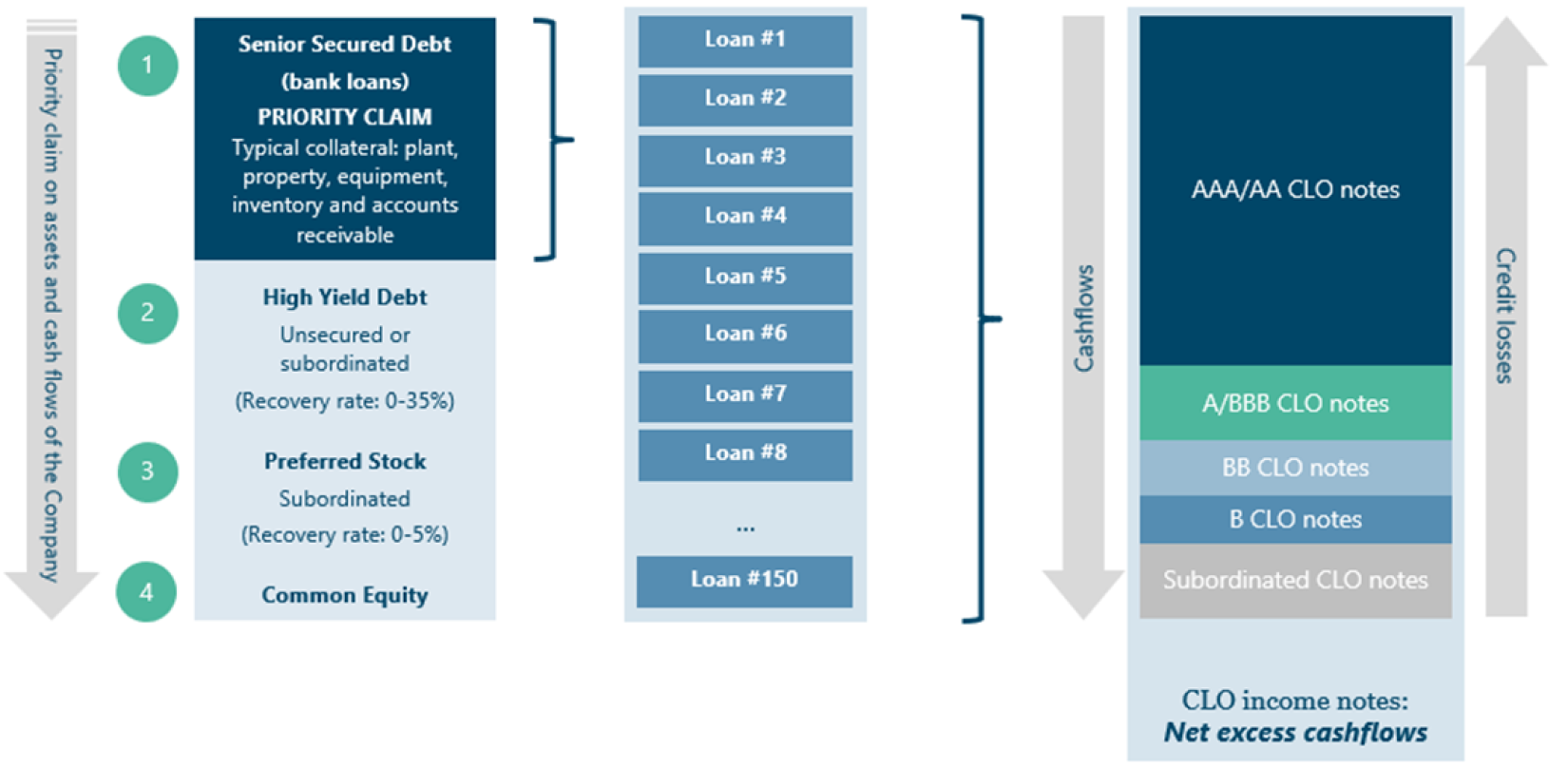

A CLO ETF offers accessible exposure to floating-rate debt.

Historically CLOs have been a more difficult market for investors to gain exposure to, often limited to banks or pension funds to invest directly.

2. TRANSPARENCY

While the portfolio is actively traded, ETF holdings are regularly published with a full portfolio breakdown.

The Fair Oaks AAA CLO Fund offers investors access to an existing, high-quality, diversified portfolio. FAAA is compliant with the UCITS directive and diversification rules.

3. EFFICIENCY AND LIQUIDITY

CLO ETFs can provide diversification to fixed income portfolios without taking illiquidity risk.

The Fund offers investors the option to invest in either ETF or non-ETF share classes. As listed classes, the ETF classes offer enhanced liquidity by enabling investors to quickly gain exposure to the CLO market and effectively rebalance portfolios as required.

Register for emails from Fair Oaks Capital

Stay up to date with the latest CLO market insights and news from Fair Oaks Capital

Frequently asked questions

- No AAA-rated CLO has ever defaulted. This can give comfort to investors about its risk profile and speaks to its resilience through market cycles, as the first CLO was issued over 25 years ago.

- CLOs are floating rate, which means they also minimize any interest rate risk.

- CLOs offer a higher yield compared to many fixed income products, providing investors an attractive risk-adjusted return.

Contact us

London

Fair Oaks Capital Ltd, 1 Old Queen Street, London SW1H 9JA

New York

Fair Oaks Capital US LP