Capital is at risk. The value of your investment may go down as well as up and you may not get back the amount you invested. Investors should read the key risks section and important information section of this page, KIID and Prospectus prior to investing.

GLOSSARY

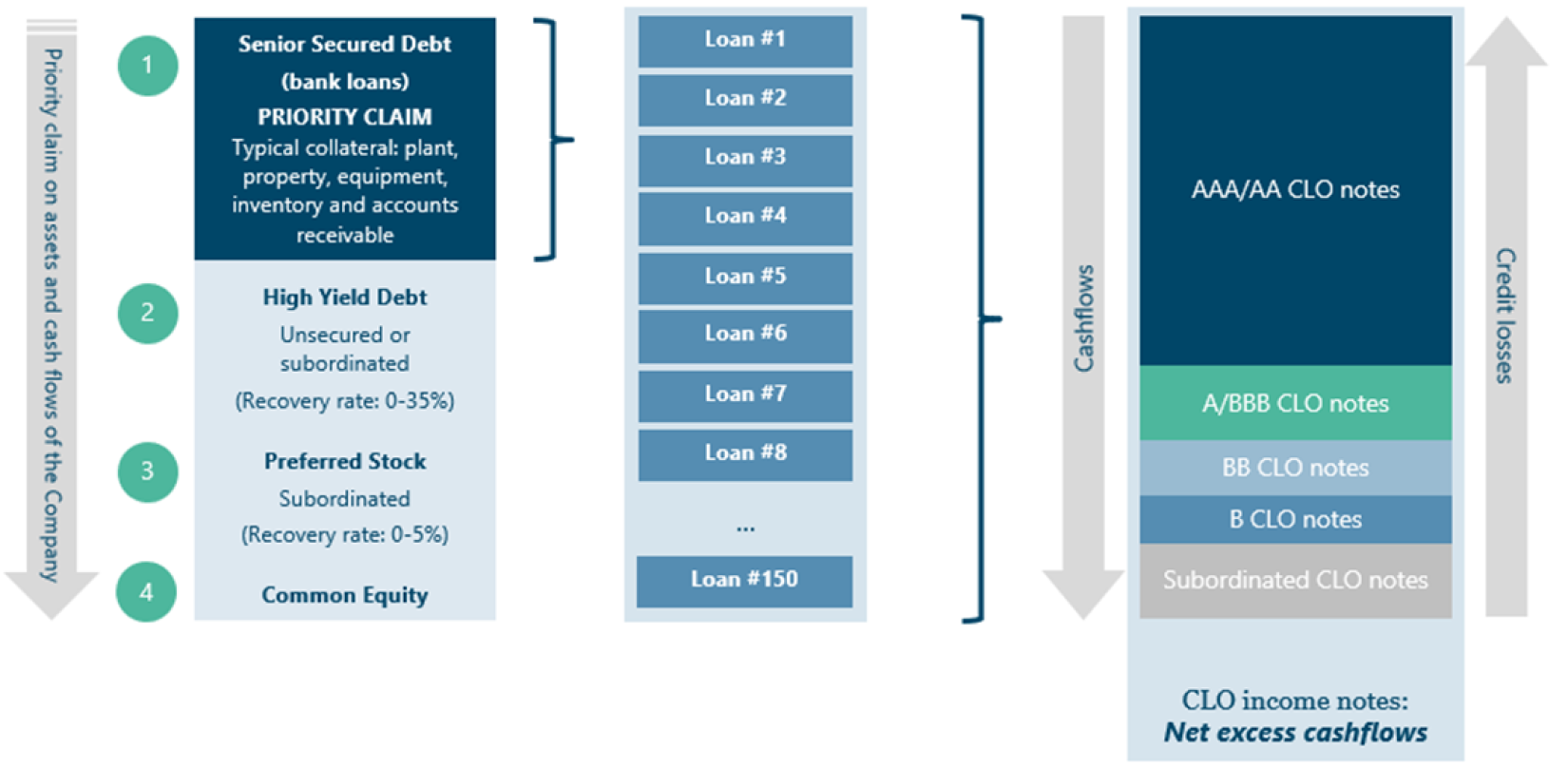

Collateralised Loan Obligation (CLO): Securities backed by corporate debt assets. Both CLO securities and underlying assets are typically floating-rate, meaning a regular but variable interest payment is received as it is tied to a benchmark rate (typically EURIBOR in Europe and SOFR in the US). CLO securities are issued in multiple classes ranging from rated debt notes (typically AAA to BB/single-B) to first-loss equity notes. The principal and interest received from CLO’s assets is allocated between the classes. CLO debt is sequentially protected by loss-absorbing junior–ranking notes, while the equity note bears the first risk of default on the CLO’s assets. The payment of interest and principal to holders of CLO equity notes will only be made from the cash flows received on the CLO’s assets after senior ranking classes and expenses of the CLO have been sequentially paid, starting from the most senior class outstanding.

Sustainable Finance Disclosure Regulation (SFDR) classification: Article 8 indicates that the product promotes environmental or social characteristics.

Total Expense Ratio (TER): A measure of the total costs associated with managing and operating the product. This primarily consists of management fees and operating expenses such as trustee, custody or registrations costs. Expressed as a percentage of assets under management.

Current yield: Weighted average current coupon of assets held by the portfolio divided by the weighted current market price of the portfolio. Expressed as a percentage. The coupon of a CLO is typically paid quarterly and is tied to a reference rate (typically EURIBOR in Europe and SOFR in the US). Expressed as a percentage.

Spread to maturity: The discount margin over the benchmark rate (typically EURIBOR in Europe and SOFR in the US) that equates the present value of the portfolio’s cash flows with its market value, if all investments are held to their expected maturities. Expressed as an annual percentage.

Spread duration to maturity: Sensitivity of a bond’s price to a change in spreads, modelled based on expected average life for the invested portfolio. Expressed in years.

Total return: The change in value of an investment over a certain timeframe. It includes any net income (such as dividends) and change in capital value. Typically measured net of any fees. Expressed as a percentage change.

Interest rate duration: A measure of the responsiveness of a fixed-income investment’s price to changes in interest rates. Expressed in years.

Undertakings for collective investment in transferable securities (UCITS): A European regulatory framework for open funds investing in listed securities, authorised and monitored by a regulatory body (such as the Commission de Surveillance du Secteur Financier in Luxembourg or the Central Bank of Ireland in the Republic of Ireland).

Key investor information document (KIID): A short, two-page, document containing essential information about a fund, providing investors an understanding of the key risks and helps them to make an informed investment decision.

KEY RISKS

The following risks may affect the Sub-Fund. Full details of all risks the Sub-Fund is exposed to are provided in the Prospectus.

CLO valuation: The value of a CLO may be affected by a number of factors, including: credit spreads, changes in the performance or the market’s perception of the underlying assets backing the security and changes in the market’s perception of the adequacy of credit support built into the security’s structure to protect against losses.

CLO liquidity: The secondary market for CLOs may not be as liquid as the secondary market for corporate debt. As a result, the Investment Manager could find it more difficult to sell these investments or may be able to sell them only at prices lower than if they were more widely traded. It may be difficult to establish accurate prices for such investments for the purposes of calculating the Sub-fund’s Net Asset Value. Therefore, prices realised upon the sale of such investments may be lower than the prices used in calculating the Sub-fund’s Net Asset Value.

Dependence on Managers of CLOs: The performance of the Sub-fund’s investments in CLOs will depend in part upon the performance and operational effectiveness of the managers of the CLOs.

Secondary Market Trading Risk: There is no guarantee that trading of ETF Shares on stock exchanges shall be possible including in, but not limited to, the following circumstances (i) such listing has not been achieved and/or maintained, (ii) the rules and requirements of any stock exchanges applicable to the listing of ETF Shares have changed or (iii) trading on such stock exchanges is suspended due to market conditions. Notwithstanding the listing of the ETF Shares on one or more stock exchange, there is no guarantee as to the liquidity of the ETF Shares on any stock exchange or as to the correlation of the trading price of ETF Shares on any stock exchange and the Net Asset Value for such ETF Share. On any given stock exchange, ETF Shares may trade at, above or below their Net Asset Value and such trading price may fluctuate in accordance with changes in the daily Net Asset Value, intraday changes in the Net Asset Value and market supply and demand for ETF Shares.

IMPORTANT INFORMATION

Past performance is no indication of future results. Inherent in any investment is the potential for loss. Target returns and distributions are hypothetical targets only and are neither guarantees nor predictions or projections of future performance. There can be no assurance that such targeted returns will be achieved or that the product will be able to achieve its investment objective, policy or strategy or avoid substantial losses. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

The classes of ETF Shares (hereafter the “ETF Shares”) referenced in this document are issued by Fair Oaks AAA CLO Fund (the “Sub-Fund”), a sub-fund of Alpha UCITS SICAV (the “Company”), a public limited liability company incorporated as an investment company with variable capital under the laws of Luxembourg and registered pursuant to part I of the act dated 17 December 2010 on undertakings for collective investment. This document should be read in conjunction with the prospectus, the relevant supplement and the Key Investor Information Document (KIID) relating to the Sub-Fund and its ETF Shares (together the “Offering Documents”). Any offer or subscription for ETF Shares may only be made on the basis of such Offering Documents. The indicative intra-day net asset value of the Sub-Fund is available at https://www.solactive.com

Investors may not create or redeem ETF Shares of the Sub-Fund directly with the Company. Only Authorised Participants may trade directly with the Sub-Fund. Investors must buy and sell ETF Shares on the secondary market, being those stock exchanges on which the ETF Shares trade, although certain investors may be able to create/redeem through Authorized Participants. Please refer to the Offering Documents for further details. There can be no guarantee that an active trading market for ETF Shares will develop or be maintained on such exchanges or that those exchange listings will be maintained.

No undertaking, representation, warranty or other assurance is given, and none should be implied, as to, and no reliance should be placed on, the accuracy, completeness or fairness of the information or opinions contained in this document. The information contained in this document is subject to completion, alteration and verification. Save in the case of fraud, no liability is or will be accepted for such information by the Investment Manager or any of its directors, officers, employees, agents or advisers or any other person.

The distribution of this document in jurisdictions other than the United Kingdom may be restricted by law and therefore persons into whose possession this document may come should inform themselves about and observe any such restrictions. In particular, information contained within this document is not for distribution in or into the United States or Canada. Any failure to comply with these restrictions may constitute a violation of the securities law of such jurisdictions.

Fair Oaks Capital Ltd (FRN: 604090) is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

ADDITIONAL INFORMATION

Notice to Swiss investors: The distribution of the Sub-Fund is restricted exclusively to qualified investors in accordance with art. 10 para. 3 of the Swiss Collective Investment Schemes Act. Performance results referring to a period of less than twelve months are no reliable indicator for future results due to the short comparison period. Issuance and redemption commissions are not included in the performance figures. The domicile of the Sub-Fund is Luxembourg. For interested parties, the Offering Documents, articles of association as well as the annual and semi-annual reports may be obtained free of charge from the Swiss representative and paying agent in Switzerland: RBC Investor Services Bank S.A., Esch-sur- Alzette, Zurich Branch, Bleicherweg 7, CH-8027 Zurich.