Shortlisted

30-Oct-24A new way to invest in AAA CLOs

06-Nov-24Shortlisted

30-Oct-24A new way to invest in AAA CLOs

06-Nov-24Insights

Introduction to CLO debt

Introduction to CLO debt: with a focus on AAA-rated CLOs

Fair Oaks’ core belief is that the CLO market generates consistent, repeatable, and superior risk-adjusted returns over multiple market cycles versus other credit strategies.

CLOs offer:

- Attractive yield versus similarly rated credit assets

- Historically low default rate through multiple market cycles

- Minimal interest rate risk

Collateralised loan obligations (“CLOs”) offer floating-rate exposure to credit, more specifically senior secured corporate loans. There is growing interest in alternative investments, and in floating-rate credit in particular given the currently attractive yields and minimal interest rate risk. CLOs are well positioned to access this market while uniquely benefiting from intrinsic features supporting investors.

CLOs can offer high yields in excess of other equivalently rated credit assets as their structure provides a wide range of investment options to investors.

The secured nature and positive historical track record of the underlying floating-rate assets, coupled with the credit protections of the CLO structure, has resulted in a very low default record for rated CLO notes through multiple credit cycles. For example, no AAA-rated CLO note has ever defaulted.

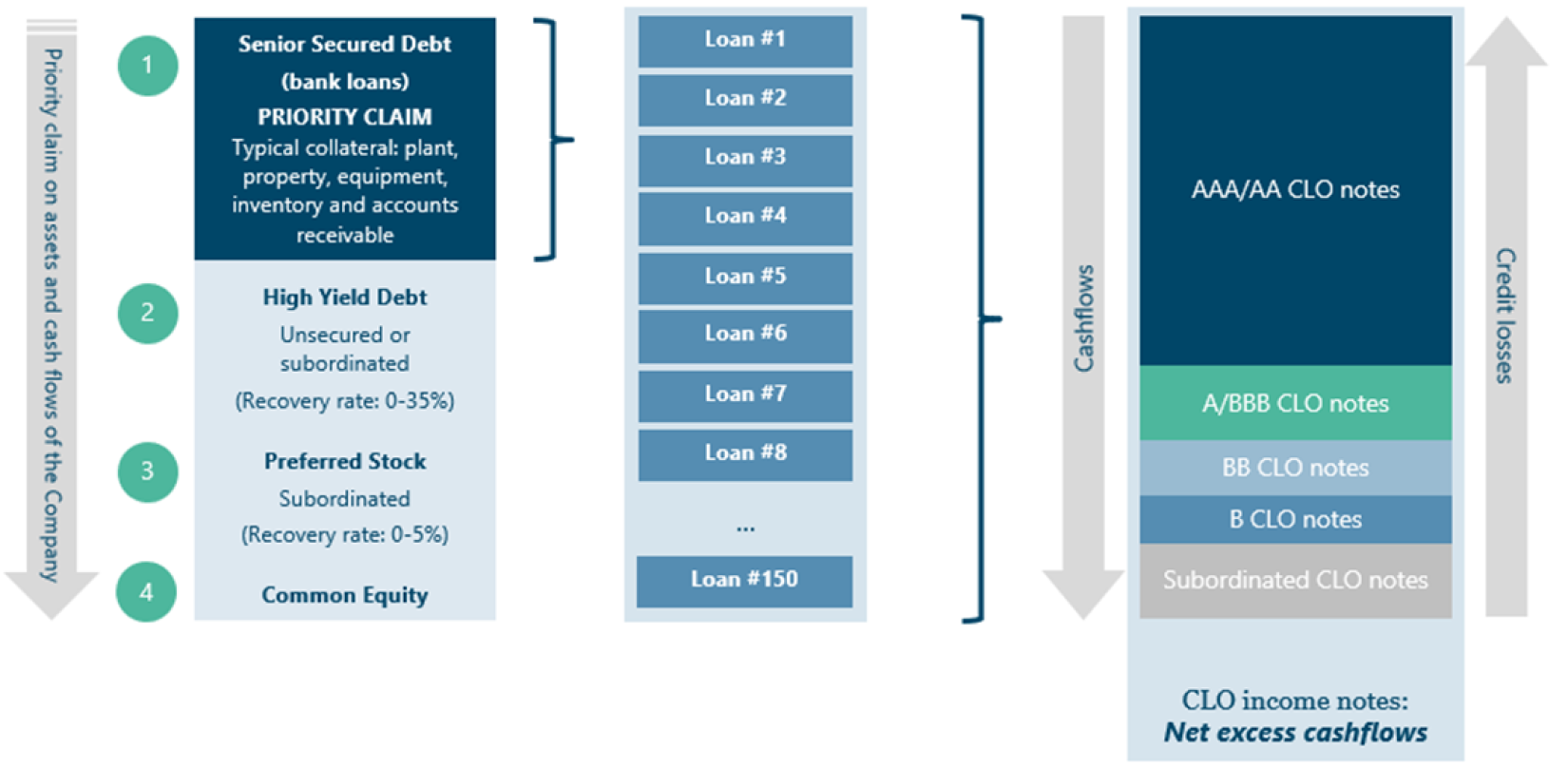

The structure of a CLO

Overview

CLOs are actively managed diversified portfolios of senior secured loans, typically from 100-300 large corporate issuers. While loans typically have extended settlement periods, CLOs settle on a T+2 basis in Europe as they are tradable securities, providing liquidity to investors. Each CLO is efficiently financed by long-term debt notes and a first-loss equity note. This combination of diverse underlying senior secured loans, coupled with the structural integrity and flexibility of the CLO structure, enables CLOs to stand apart in the credit markets.

Debt notes sequentially receive quarterly interest payments through a cashflow waterfall. Payments are first made to senior debt notes (rated AAA), then in turn to junior debt notes (rated BB or single-B), with net excess cashflows paid to the equity tranche.

Subordination provides protection to debt notes as credit losses flow up through the capital structure. This has resulted in CLOs having lower historical default rates than similarly rated and even higher rated corporates.

As a result of the range of credit ratings assigned to CLO debt notes, CLOs attract a broad and stable investor base, from banks, pension funds and insurance companies to specialized asset managers and hedge funds. Consequently, the CLO market now stands at over $1 trillion in size, making it an established and liquid asset class. Given the 25+ year track record, liquidity profile and opportunity for exposure to loans, CLOs are a key asset class for investors to consider in order to diversify a portfolio.

CLO collateral: senior secured bank loans

Broadly syndicated loans ("BSL"), otherwise known as senior secured bank loans, form the majority of the assets within a CLO. These are loans to large corporates, often backed by private equity, with a minimum EBITDA/facility size, rated BB+ or below and syndicated by banks to a range of institutional investors.

While BSLs are high-yield by nature, their first-lien position within the capital structure means that, in the event of default, loans can achieve higher recovery rates than junior debt such as high-yield bonds. From 2002-2021, the average recovery for first-lien term loans was 76%, compared to 39% for second-lien and 35% for unsecured notes.1 The average default rate of loans has also been historically lower than that of high-yield bonds.2

A CLO must adhere to multiple portfolio guidelines, requiring active management to ensure compliance with regular tests. These tests ensure that a minimum diversification level and maximum level of risk is maintained.

CLO financing: rated debt and first-loss equity tranches

A CLO is similar to a financial institution as it uses long-term, non-recourse, non-mark-to-market debt to finance the acquisition of a diversified portfolio of senior secured bank loans. The debt is issued as rated tranches and a first-loss equity note. Through this structure, CLOs offer varying levels of risk and return, with CLO notes benefiting from protection against credit losses through subordination (with the first loss borne by the equity note) and cashflows flowing through a “waterfall”.

In addition to the asset diversification and credit enhancement of CLO notes provided by its structure, intrinsic features support noteholders and have enabled CLOs to weather multiple market cycles with low default rates – no European AAA CLO note has defaulted and the annualised 10-year default rate for BB notes is only 0.22%.3 CLOs do not have any significant currency or interest rate mismatch. Floating-rate assets are matched with floating-rate financing and any currency mismatch is hedged. Unlike banks, CLOs strictly manage the maturity of assets and liabilities as CLO notes have longer maturities than the loans they finance and regular tests ensure compliance throughout the CLO’s lifecycle. For example, if a tranche’s test is breached, self-correction mechanisms allow for the redirection of cashflows until tests are met, directing cashflows away from more junior tranches and the equity note.

Crucially, CLOs benefit from no mark-to-market risk, meaning they are not forced to post margin or sell assets during market downturns. Ultimately, performance of CLO notes is primarily driven by actual default losses, not mark-to-market volatility. During 2008 and 2020, CLOs demonstrated their resilience to stressed market conditions. CLOs issued just before periods of stress were able to benefit most from volatile markets given their non mark-to-market, actively managed portfolios.

CLO lifecycle

During the life of a CLO, the vehicle is actively managed to add value and reduce credit risk. The CLO manager trades loans and adjusts the positioning of the portfolio to take advantage of changing market conditions (subject to investment guidelines and compliance of tests).

After the end of the reinvestment period, loan principal repayments are used to pay down CLO liabilities, starting from the most senior AAA CLO notes and following the same “waterfall” as interest payments. Often the CLO is called before maturity, meaning the CLO debt is repaid at par, realising any current market discount.

Understanding key events during a CLO's lifecycle such as non-call period, re-investment period and deleveraging

Non-call period

During the non-call period, a CLO is unable to be called. This means this is the minimum period during which the CLO will be outstanding and during which the deal cannot be refinanced/reset. This period is typically 1 to 2 years.

Re-investment period

During the re-investment period, a CLO manager can actively trade the portfolio of loans, enabling a CLO manager to mitigate risks within the portfolio by selling loans, as well as invest in new loans. Trading is subject to portfolio limits and ongoing tests to set out in a CLO's documentation. This period is typically 3-5 years.

Deleveraging

After the end of the re-investment period, the CLO structure naturally deleverages (also known as amortizes) over time as loan repayments are limited from being reinvested. Instead, loan principal proceeds are typically used to repay CLO noteholders in the same waterfall sequence as interest payments, first repaying the AAA notes completely before repaying lower tranches. While theoretically this occurs until no CLO debt notes are outstanding, in practice the deal is typically called by the CLO equity holder around 2 years after the end of the reinvestment period when the deal has sufficiently deleveraged.

Key risks of CLOs and the mitigants

Credit risk

Credit losses within their loan portfolios are the ultimate driver of performance for CLOs. Therefore, CLOs aim to minimise this risk through:

- Avoiding idiosyncratic risk through a diversified portfolio of loans across multiple sectors.

- Structural credit enhancement and ‘self-correcting’ features, such as excess interest, overcollateralisation, and potential cashflow diversion.

- Active management by the CLO manager with loan portfolio constraints.

While loan default rates have spiked during stressed periods, there has never been a sustained level of loan default losses over several years that was high enough to cause a significant number of CLO (junior) notes to default.4

Extension risk

If loans are not repaid as initially expected, and instead amended to extend maturities, this can prolong the CLO’s amortisation (deleveraging) profile, meaning principal repayments of CLO debt can be later than anticipated. CLO documentation has evolved to limit a CLO manager’s participation in these transactions.

Analysing different CLOs

While CLO structures and documentation are somewhat standardised, each CLO is different, warranting individual analysis of each CLO and constant monitoring of portfolios. This analysis should include a fundamental review of loan portfolios, as well as detailed analysis of the deal’s structure, documentation, current metrics, and the CLO manager’s track record and style.

Advantages associated with CLOs

Liquid corporate credit exposure without taking idiosyncratic risk

CLOs offer an efficient access to an attractive asset class, floating-rate credit, wihile avoiding some of the credit and liquidity risks of investing directly in loans or loan funds. Unlike a loan fund, in which investors take a pro-rata share of credit losses, CLO debt holders mitigate against such idiosyncratic risk through structural subordination. Bank loan fund liquidity is also constrained by long settlement process (loan assignment). Conversely, CLO notes are securities and settle on a T+2 basis in Europe, enabling investors to gain exposure via open-ended funds with daily liquidity.

Attractive spread pick-up within credit

The spread of CLO debt tranches offers investors enhanced risk-adjusted returns within alternative credit and versus similarly rated corporates, while also catering to different investor risk appetites.5 For example, AAA-rated CLOs can offer a meaningful spread pick-up versus similarly rated and even lower-rated BBB corporates.

Floating rate debt with minimal interest rate risk

Given their floating rate nature, CLOs offer investors minimal interest rate. This means that CLOs do not suffer the same pricing sensitivity to changing interest rates, such as fixed-rate high-yield bonds. Given the uncertainty surrounding central bank policies, and the potential for a “higher-for-longer” scenario CLOs can offer investors enhanced yields versus traditional fixed income products with longer duration such as high-yield bonds.

Defensive and long track record of minimal defaults

Given the structural subordination and credit enhancement features embedded within CLOs, cumulative defaults since 1981 have been significantly lower than similarly rated corporates.6

Active portfolio management by CLO manager

As a CLO manager actively trades the portfolio over a lifecycle, CLOs can mitigate risk and take advantage of developing market conditions, despite not being marked-to-market. This enables managers to manage default risk from any downward credit migration, participate in new transactions as other loans are repaid, and ensure continued compliance with all diversification requirements and coverage tests required by the CLO structure. When investigating in a well-managed fund of CLOs, there are ultimately two investment teams examining the loan portfolio - the CLO manager and the investment manager selecting the note.

Accessing the CLO market

Traditionally, the CLO market was largely reserved for institutional investors such as banks and pension funds. Given the CLO market’s growing size and efficient trading, more open-ended funds have offered exposure to CLOs in recent years. Today, investment is now possible through ETFs, allowing additional market participants to gain access to the CLO market.

Conclusion

CLO market key points:

- CLOs provide exposure to diversified pools of senior secured loans with non-mark-to-market financing.

- CLOs offer different risk-return profiles with CLO debt notes rated AAA through B and unrated CLO subordinated CLO notes (or “CLO equity”).

- CLOs can provide a valuable addition to a diversified fixed income portfolio given their attractive risk-adjusted return and floating-rate nature.

- CLOs offer a substantial yield increase compared to similarly rated bonds.

- CLOs have experienced default rates far below similarly rated corporate bonds.

- CLOs are an established and liquid market with a 25+ year track record and the global CLO market is over $1 trillion in size.

AAA-rated CLO notes key points:

- AAA-rated CLOs are positioned at the top of the CLO capital structure, offering the highest level of overcollateralization

- No AAA-rated CLO has ever defaulted

- AAA-rated CLOs offer a meaningful spread pick-up versus corporates.

Endnotes

- Fitch's," U.S. Leveraged Finance Restructuring Series: Ultimate Recovery Rate Study (First-Lien Term Loan Recoveries Dip in 2020, Begin to Recover in 2021)", 21-Mar-22.

- Bank of America as at 30-Sep-24. Long-term average US default rate since Mar-03, when data is available.

- S&P's, "Default, Transition, and Recovery: 2022 Annual Global Leveraged Loan CLO Default And Rating Transition Study", 10-year time horizon, 13-May-23.

- Bank of America and Pitchbook LCD. Average par subordination of European CLO tranches between 2013 and 2022. For illustrative purposes only.

- JP Morgan as at 30-Sep-24. Euro AAA CLO primary DM, Corporate (includes Industrials and Financials) AAA to BBB 3-5 year maturity asset swap spread.

- S&P's, "Default, Transition, and Recovery: 2022 Annual Global Leveraged Loan CLO Default And Rating Transition Study", 10-year time horizon, 13-May-23. S&P's "Default, Transition, and Recovery: 2022 Annual Global Corporate Default And Rating Transition Study", 10-year time horizon, 25-Apr-23.