FT

10-Sep-24Investment Officer

19-Sep-24FT

10-Sep-24Investment Officer

19-Sep-24Press Release

Fair Oaks Capital Lists First European-Domiciled AAA CLO ETF on Xetra

Fair Oaks Capital has listed the first European AAA CLO ETF on Deutsche Börse Xetra and Börse Frankfurt (ticker: LAAA), offering access to AAA-rated, floating-rate CLO notes. Trading commenced today.

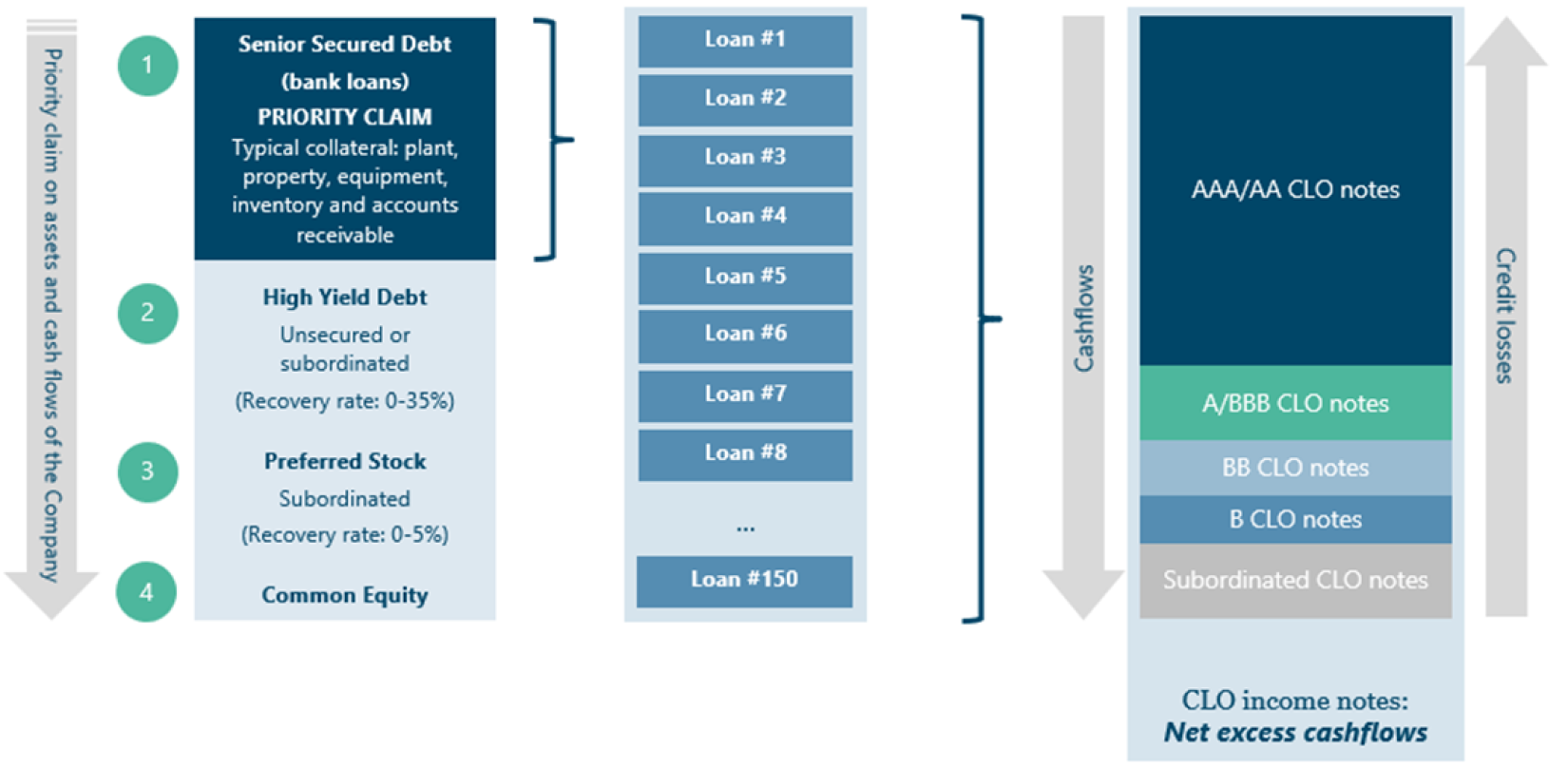

Fair Oaks AAA CLO ETF (FAAA) invests in AAA-rated CLOs. FAAA was launched on the Alpha UCITS fund platform as an additional listed share class of an existing Fair Oaks UCITS fund, the Fair Oaks AAA CLO Fund (the Fund). The Fair Oaks fund was launched in 2019 with Alpha UCITS and has over €150 million in assets under management as of Aug. 30, 2024. The ETF share class offers investors access to the existing, high-quality, diversified portfolio. The Fund invests exclusively in AAA-rated CLOs, based on Fair Oaks' established investment processes. FAAA is a long-only portfolio with no leverage and is classified as Article 8 under the EU Sustainable Finance Disclosure Regulation (SFDR).

The ETF is managed by a team of six professionals, supported by the broader Fair Oaks credit team and led by Miguel Ramos Fuentenebro and Roger Coyle, co-founders and partners of the firm.

Ramos Fuentenebro, said, "The Fair Oaks AAA CLO ETF gives investors efficient access to a broad range of AAA-rated floating-rate instruments. These assets have demonstrated a flawless performance record: from 1997 to 2023, no AAA-rated CLO note has defaulted, as confirmed by S&P Global. We are confident that the CLO market provides consistently strong, repeatable risk-adjusted returns across different market environments, outperforming many other credit strategies."

Stephane Diederich, CEO of the Alpha UCITS platform, emphasized the strategic importance of launching the Fair Oaks AAA CLO ETF share class with an initial fund size of over €150 million, making it highly attractive for institutional investors.

"The fund is well-positioned to meet the demands of institutional investors who often seek to deploy large capital allocations without exceeding ownership limits of a single ETF for risk management purposes. This allows investors to gain meaningful exposure while maintaining balanced risk across their portfolios," Diederich said.

The total expense ratio for the Fair Oaks AAA CLO ETF is 0.35 percent.