Introduction to CLO debt

06-Nov-24ETF Stream

12-Nov-24Introduction to CLO debt

06-Nov-24ETF Stream

12-Nov-24Insights

A new way to invest in AAA CLOs

A new way to invest in AAA CLOs: Europe's first AAA CLO ETF explained

ETFs have enabled a broader range of investors to gain access to different asset classes, thereby unlocking new investment opportunities. Credit ETFs offer investors daily liquidity to a previously difficult to access corporate credit market, along with transparency and cost efficiency.

CLO ETFs have become increasingly popular in the US, given the structural benefits and higher return profile of CLOs all within the accessibility and tradability of an ETF wrapper. Fair Oaks brings this asset class and structure to Europe in the form of European CLO ETFs.

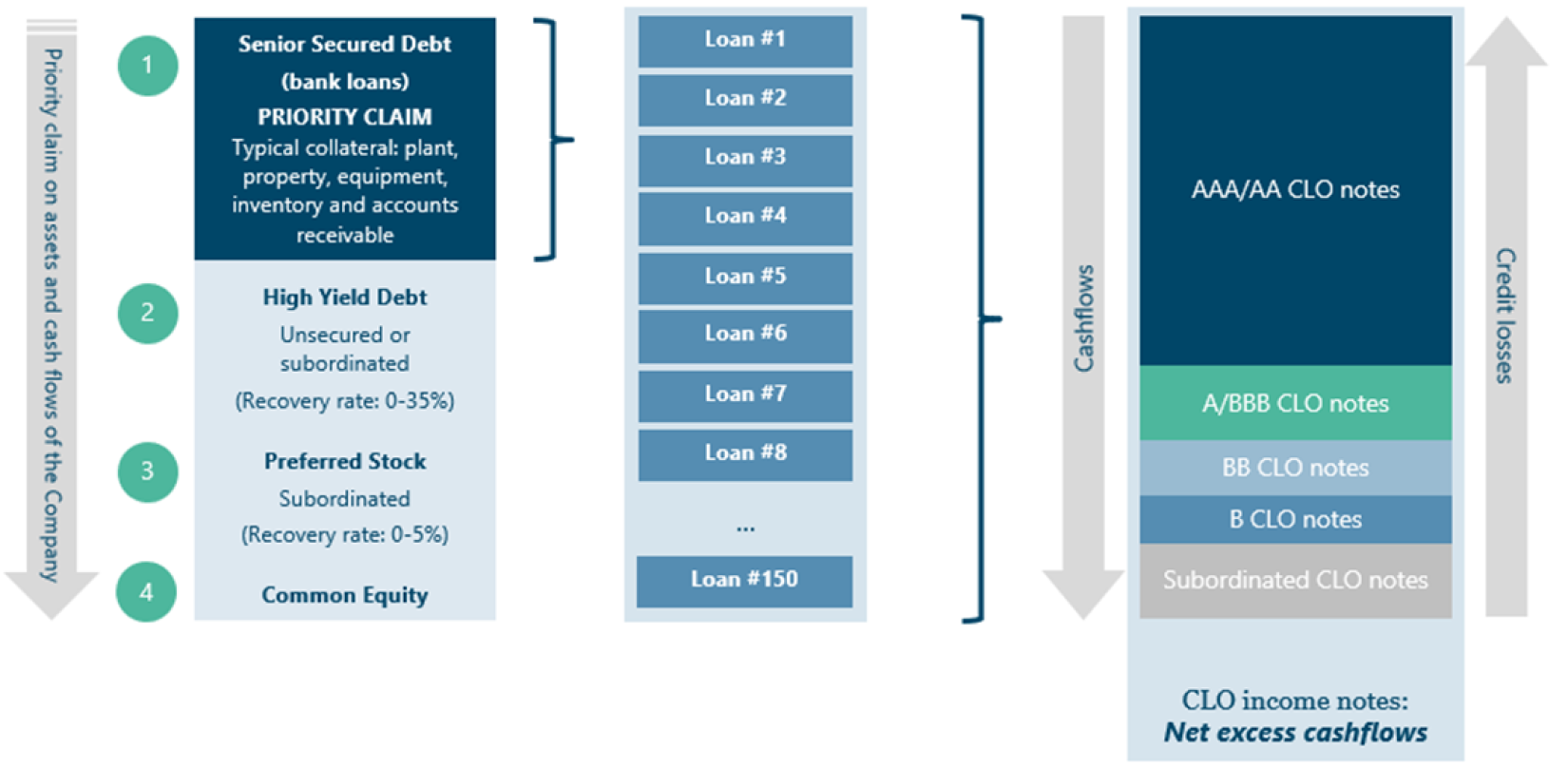

In Europe, access to higher yielding floating-rate debt is challenging for investors to obtain. With fixed income yields less attractive in a higher and uncertain rate environment, investors should look for alternative sources of returns to provide diversification to portfolios, without taking additional risks of illiquidity or complex and costly structures. CLOs provide access for investors to gain exposure to floating-rate corporate credit through public markets.

Access to CLOs have largely been reserved for banks, pension funds, insurance companies and other specialist institutional investors. As ETFs promote liquidity, transparency and democratization of assets, the use of this structure to invest in CLOs has opened barriers for new investors. Therefore, a wider audience can benefit from the higher carry, downside protection and diversification of CLOs.

Efficient trading with daily liquidity

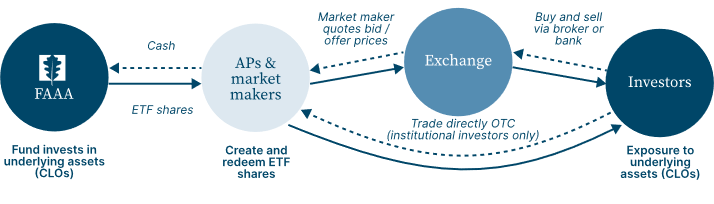

CLO ETFs trade in the primary and secondary markets, creating liquidity across multiple channels. This enables investors to access CLOs in a low cost, transparent and accessible way.

-

-

ETF asset liquidity (CLO market): The large size and liquid nature of the CLO market helps to provide underlying liquidity for the ETFs. The global CLO market stands at $1 trillion and growing, with both large primary market volumes and active secondary market trading. Investors trading CLO ETFs gain direct access to the fund’s actively managed portfolio of CLOs.

-

Primary market liquidity: Shares in the primary market are created and redeemed by Authorised Participants. This allows for large flows without unnecessary volatility and allows the ETF share price to track to the NAV of the fund’s CLO assets. The ETF can also trade even without exchange driven secondary market flows as investors can buy and sell directly with Authorised Participants via OTC trades.

-

Secondary market liquidity: The ETFs are available on multiple exchanges, such as the London Stock Exchange and Deutsche Borse, enabling a pan-European investor base daily access to CLOs. Investor-to-investor trading of shares occurs on exchanges via brokers with a bid-offer spread set by market makers. This democratises access to a wider investor base and provides investors more control.

-

European ETFs are often classified as UCITS funds. This is a widely-recognised cross-border framework which promotes standardization of certain procedures, ensures appropriate governance structures and requires minimum portfolio diversification and risk management. This therefore reduces counterparty risk and enables access to a broader investor base.

The investment case for AAA-rated CLOs

Attractive returns

CLOs can offer higher returns than other fixed income products.

Resilient asset class

No AAA-rated CLO has ever defaulted (25+ year track record).

Access to rated floating rate debt

Assets pay 3-month Euribor plus a margin.

Low volatility profile

AAA-rated CLOs have demonstrated a 5-year historical volatility marginally higher than (2-year) German government bonds and significantly less volatility than other fixed income products such as IG corporate bonds.

For more information, please visit http://www.clo-etf.com/insights

A CLO ETF can be used for strategic allocation – taking a long-term approach to investing in CLOs while benefiting from the transparency of the structure, with full portfolio holdings and daily pricing made widely available. Alternatively, investors can allocate tactically – taking advantage of the daily liquidity and efficiency of the structure to flexibly rebalance portfolios or quickly gain exposure to the asset class.

Transparent European credit access

Unlike some other fund structures, ETFs enable transparent exposure to the underlying fund holdings, gaining efficient and quick access to the asset class. While US investors have been able to gain access to CLOs through US CLO ETFs for some time, certain European investors have been unable to access the asset class in the same way. Importantly, EU and UK ‘institutional investors’ are required to comply with securitisation (risk-retention) regulations when gaining exposure to CLOs, meaning that it is important that assets within a fund are compliant with those regulations.

Historically, allocating to European corporate credit funds has often meant investors are forced to accept additional risks such as illiquidity or opacity of investment portfolios. A European ETF exposed to CLOs allows investors to access floating-rate European credit and also benefit from a CLO’s structure as well as the transparency of an ETF. While CLOs are an established market, the asset class has been largely reserved for large institutional investors such as banks, pension funds, insurance companies and other specialist investors. A European CLO ETF therefore opens access to this asset class to a broader investor base.

Active portfolio management

As the CLO market has grown to over $1 trillion globally, portfolios can be actively traded to efficiently generate returns for investors. While CLO market growth has increased liquidity, pricing dispersion has also increased, requiring additional investment due diligence.

There is currently no investable CLO index for investors to use to gain access to the market. Instead, an investment in CLOs requires investment analysis and selection and portfolio construction, ideally by an experienced investment manager specialising in corporate credit and CLOs.

Fair Oaks has deep expertise in this market, having multiple decades of combined experience and a broad coverage of European corporate credit – actively investing in senior secured loans, high-yield bonds and CLO debt notes across the capital structure. Other investors may not be resourced to perform bottom-up analysis to fundamentally value CLOs to the same degree. Fair Oaks can assess the opportunities in the primary or secondary markets and tactically allocate by identifying sources of relative value.

An actively managed CLO ETF, such as the Fair Oaks AAA CLO ETF, can provide investors with the confidence to invest in the CLO market alongside large institutional investors, while diversifying their portfolios. By allocating to a CLO ETF, investors can unlock access to the alternative credit asset class, offering the potential for higher returns than other fixed income assets.