Pensions & Investments

29-Aug-24Pensions & Investments

29-Aug-24Press Release

Fair Oaks Capital Launches First European-Domiciled CLO ETF

Fair Oaks Capital, a specialist corporate credit manager, has received approval from Luxembourg regulator CSSF to launch the investment industry’s first European-domiciled, Euro-denominated CLO exchange traded fund (ETF). Fair Oaks plans to list the ETF on Deutsche Boerse Xetra on Sept. 10, 2024, pioneering a diversified CLO portfolio in an actively managed ETF wrapper to investors in Europe.

Fair Oaks AAA CLO ETF (FAAA) invests in AAA-rated CLOs. FAAA is an ETF share class of an existing Fair Oaks UCITS fund—the Fair Oaks AAA CLO Fund, introduced in 2019 and with €161 million in assets as of July 31, 2024. The ETF offers investors access to the existing, high-quality, diversified portfolio.

The fund invests exclusively in AAA-rated CLOs, based on Fair Oaks’ established investment processes. FAAA is a long-only portfolio with no leverage and is classified as Article 8 under the EU Sustainable Finance Disclosure Regulation (SFDR).

Fair Oaks plans to list the CLO ETF on Deutsche Boerse Xetra initially (Xetra ticker: LAAA) and on the London Stock Exchange shortly thereafter (LSE ticker: FAAA). It will be registered for distribution to investors in a broad range of European countries, including Austria, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Malta, Netherlands, Spain, Sweden and the UK.

The fund is managed by a team of six professionals, supported by the broader Fair Oaks credit team and led by Miguel Ramos Fuentenebro and Roger Coyle, co-founders and partners of the firm.

“Fair Oaks AAA CLO ETF offers investors liquid exposure to a diverse pool of AAA-rated floating-rate assets, which have a superb track record of no defaults since the first AAA-rated CLO was issued over 25 years ago,” Fuentenebro said. “Our core belief is that the CLO market generates consistent, repeatable, and superior risk-adjusted returns over multiple market cycles versus other credit strategies.”

London-based Fair Oaks Capital manages over $3 billion in assets as of July 31, 2024 in CLOs and corporate credit-based strategies. Fair Oaks has a dedicated, award-winning team with extensive experience managing and investing in CLOs. The firm was recently nominated for Funds Europe Awards 2024’s ‘Fixed Income Fund Manager of the Year’ and ‘European Asset Management Firm of the Year – AUM less than €20bn.’

The Fair Oaks AAA CLO ETF seeks to identify attractive risk-adjusted investment opportunities in AAA-rated CLOs via a combination of detailed credit analysis, in-depth structural and documentation review, and rigorous due diligence. Fair Oaks seeks to optimize returns through active security selection and asset allocation.

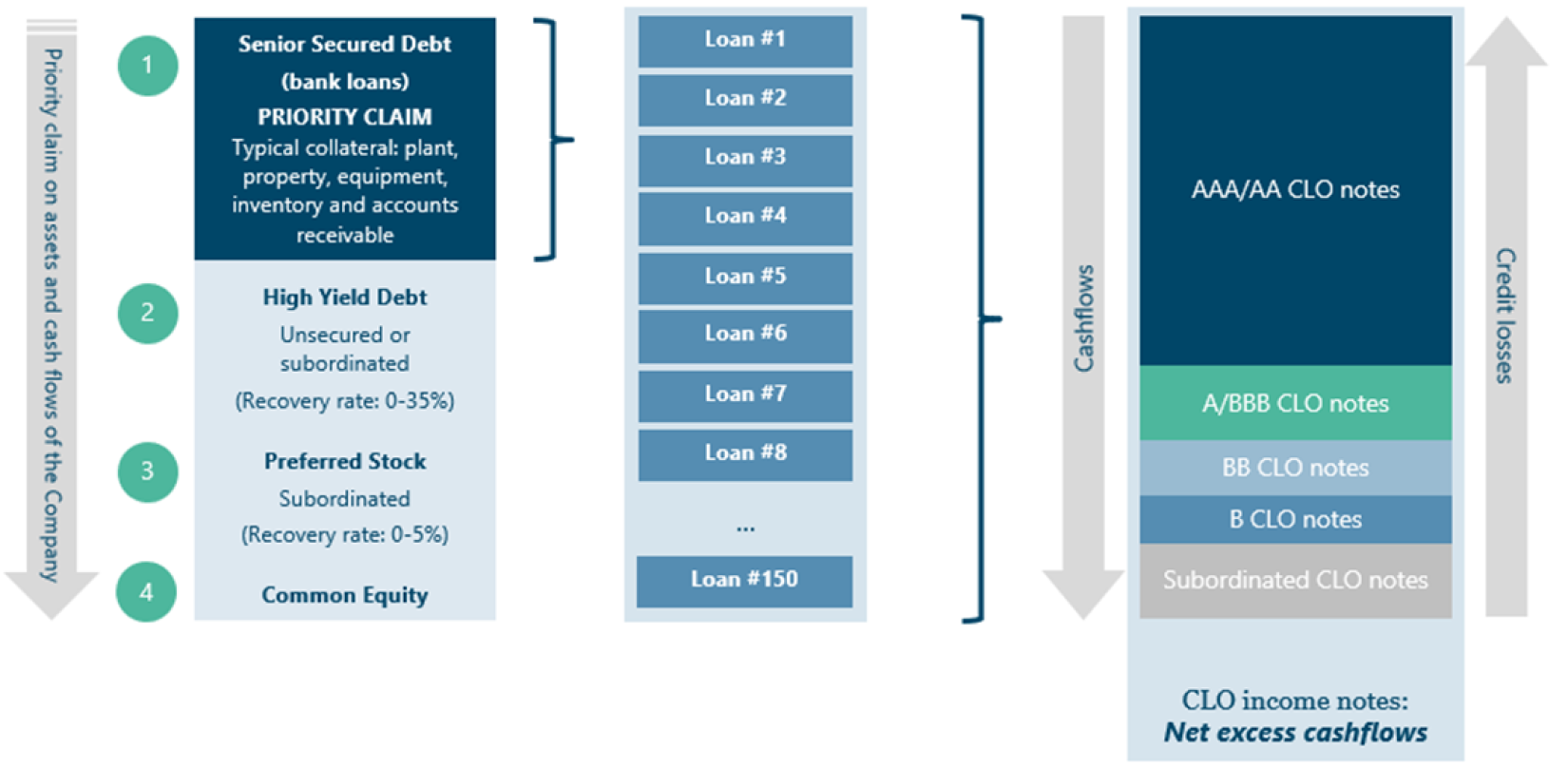

Fair Oaks believes AAA-rated CLOs offer significant value compared with corporate bonds and other asset-backed securities and benefit from the protection of loss-absorbing equity and junior-ranking debt. They also reflect minimal default risk—from 1997 to 2023, no AAA-rated CLO note has defaulted, according to S&P Global.

To date, CLO ETFs available to U.S. investors have captured considerable asset growth, because of the CLO market’s:

- Low correlation with other asset classes

- High credit quality floating-rate debt with minimal duration risk

- Established resilience with more than 25 years track record of no AAA-rated CLO defaults

The global CLO market is expected to reach more than $2.7 trillion in assets by 2028, up from approximately $1.3 trillion in assets in 2022, according to ResearchandMarkets.com.